Insights Digest provides in-depth, data-driven insights into Africa’s music industry through reports, analytics, and market data.

The potential economic value of Uganda’s music industry remains staggering, yet the vast majority of its value remains uncaptured by the very creators who generate it.

That’s according to the 2025 Uganda Music Industry Report from research group The Atlas published by Aumex, which provides the most comprehensive data-driven snapshot yet of a sector defined by a profound “Awareness-Action Gap.”

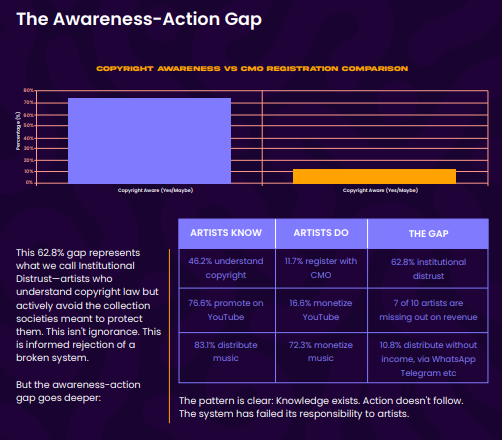

The central finding reveals a catastrophic systems failure: while 46.2% of Ugandan artists understand copyright law, only 11.7% are registered with the national Collective Management Organization (CMO).

This 62.8-percentage-point chasm represents what the report terms “institutional distrust”, a rational rejection of a system creators know does not work for them.

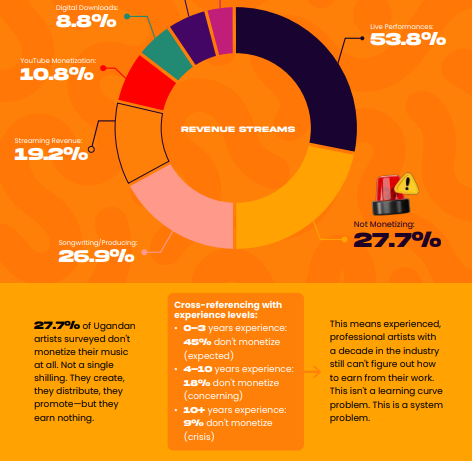

Of the total creator population surveyed, 27.7% earned UGX 0 from their music in the past year. This includes 9% of artists with over a decade of professional experience, indicating the problem transcends early-career struggle and represents a fundamental breakdown in career sustainability.

The industry is supported by a robust consumer base. The average Ugandan listens to 3.2 hours of music daily, with the core 25-29 demographic consuming 4 hours and spending UGX 50,000 monthly on music activities.

Yet the routes to monetize this engagement are fractured, with YouTube dominating as both discovery tool and listening platform while returning minimal value to local artists.

Here are five key structural failures identified in the report:

1. The ‘Awareness-Action Gap’ reveals a $56.5 billion problem of informality

While the formal cultural sector contributes just 0.2% to Uganda’s GDP, the report cites a CfCA-SELAM study estimating UGX 56.5 billion in potential tax revenue remained uncaptured over five years.

“This money exists it’s just flowing through informal channels that government can’t track or tax,” the report states. The data reveals why: only 7% of music workers have formal employment contracts, and 58.5% of cultural enterprises are micro-operations of 1-4 people.

The result is an industry that appears economically insignificant in official statistics precisely because its value is being generated and lost outside measurable systems. The report argues that “low contribution is a result of underinvestment, not a justification for it.”

2. Digital infrastructure enables consumption but blocks monetization

Uganda has achieved the digital penetration often seen as prerequisite for a modern music economy: 44.3 million mobile subscriptions, 16.5 million mobile internet users, with TikTok reaching 50% of smartphone users. Yet streaming penetration remains at approximately 11%, and most artists earn “almost nothing” from digital distribution.

The report identifies the disconnect: average monthly data usage of 5.1GB goes primarily to TikTok, WhatsApp, and YouTube platforms with notoriously difficult monetization paths for African creators.

“The infrastructure exists for consumption but not for compensation,” the report suggests, creating what might be termed “extractive digitalization” where global platforms capture audience attention while returning minimal value locally.

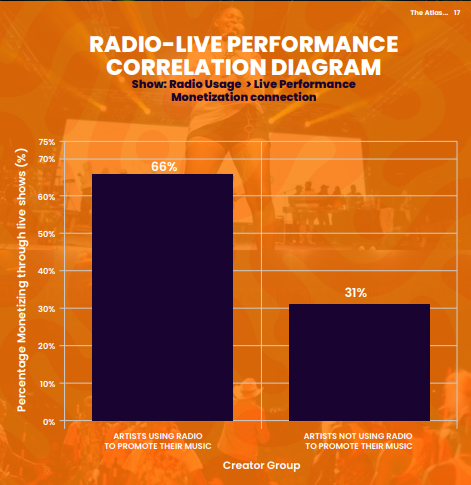

3. Radio’s paradox: Declining relevance with persistent economic power

While 62% of Ugandans rarely or never listen to radio especially among the youth demographic, the medium retains disproportionate economic influence.

Artists who use radio promotion are 2.1 times more likely to secure live performance revenue. The data shows 65% of regular radio listeners attend six or more live events annually, versus 31% of non-listeners.

However, this influence comes with significant limitations. Radio listeners represent a price-sensitive demographic, spending UGX 49,000 on average per ticket versus UGX 85,000 for those who never listen to radio. Furthermore, less than 40% of African radio stations are fully licensed for music reporting, crippling royalty collection mechanisms.

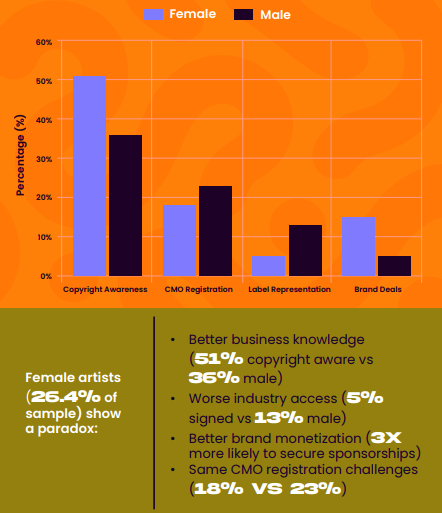

4. The gender paradox: Better business knowledge, worse industry access

Female artists (26.4% of the sample) demonstrate stronger business fundamentals, 51% are copyright aware versus 36% of male artists but face worse traditional industry access, with only 5% signed to labels versus 13% of males.

Their adaptation reveals a market innovation: female artists are three times more likely than males to secure brand partnerships and sponsorships.

This suggests they are developing expertise in newer, less gatekept revenue streams that value audience engagement over traditional industry connections.

Yet the report frames this as compensation for exclusion rather than equal access. “The gender gap isn’t about knowledge or capability,” it states. “It’s about access. Female artists know what to do; the doors just aren’t opening for them.”

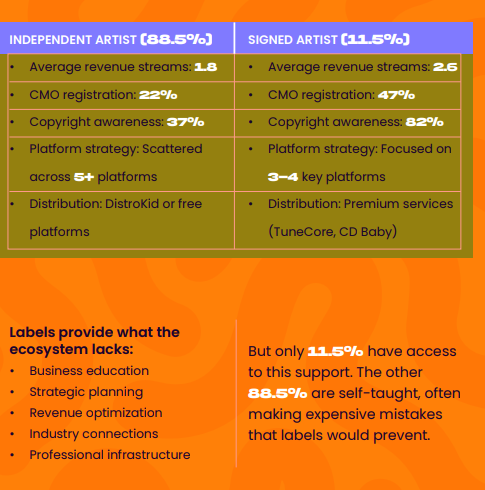

5. The three-tier hierarchy functions as a near-caste system

The report identifies a rigid three-tier structure with minimal upward mobility: the Elite (10-15%), the Middle (20-25%), and the Base (60-70%). Most creators remain trapped in the Base tier, characterized by inconsistent momentum and unreliable income.

Structural ratios reveal why mobility is limited: for every 2.5 creators, there’s only 1 manager. Only 3.6% of the music workforce handles financial roles.

These missing professional functions, management, accounting, marketing normally facilitate market transactions and resource allocation.

Without this professional middle class, artists must perform business functions for which they have no training, creating what the report calls “expensive mistakes that labels would prevent.” Only 11.5% of artists have label support, and those who do average 2.6 revenue streams versus 1.8 for independents.

The report concludes that Uganda’s challenge is not a lack of talent, digital infrastructure, or even business awareness, but rather the absence of functional systems that can translate these assets into sustainable careers.